Baamtu's Blog: Expertise in Digital Transformation

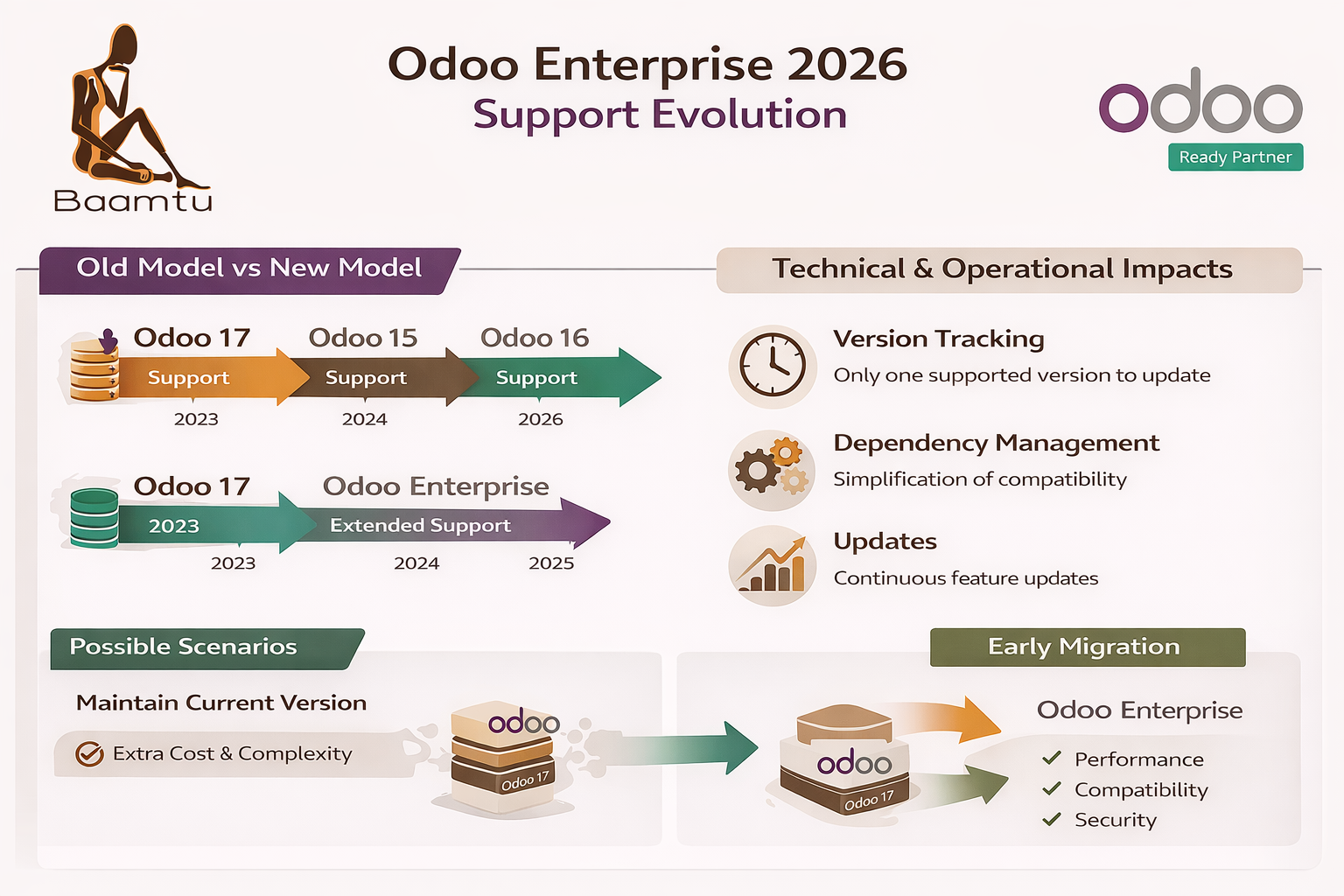

Odoo Enterprise support: technical impacts 2026

Since July 10, 2025, Odoo has announced a major change to its support policy: now, all versions of Odoo Enterprise

Read everythingMigration Odoo : Comment choisir le bon partenaire ?

Since July 10, 2025, Odoo has announced a major change to its support policy: now, all versions of Odoo Enterprise

Read everythingOdoo Enterprise: Prepare for migration before April 2026

Preparing for the migration to Odoo before April 2026 is necessary due to changes in support policy and the price increase...

Read everythingOdoo: the new support policy for 2026

Depuis le 10 juillet 2025, Odoo a annoncé une évolution majeure de sa politique de support : désormais, toutes les...

Read everything